Overview

This proposal seeks approval for the allocation of US$1 million in stablecoins from the SPACE ID DAO treasury to Latch, an omni-chain yield and restaking protocol with on-demand liquidity, offering 10%+ APYs currently (which can increase or decrease in the future depending on market conditions). These idle treasury funds could yield around US$100,000 annually, and the deposited treasury funds are always available for SPACE ID DAO to withdraw as needed. The additional DeFi revenue can be reinvested to expand SPACE ID’s ecosystem and foster long-term financial sustainability, aiding in the diversification of SPACE ID’s revenue streams.

Purpose

With a portion of SPACE ID DAO’s treasury remaining idle, this represents a meaningful opportunity to generate passive income that could support long-term ecosystem growth and governance initiatives.

With the increasing adoption of DeFi treasury strategies, other protocols like ENS DAO have successfully generated substantial revenue through DeFi yield (ENS Revenue Report: Q3 2024 - DAO-Wide - ENS DAO Governance Forum). Following the success of this model, SPACE ID can take advantage of Latch’s yield vaults to generate consistent and stable returns. Risk control mechanisms will be put in place, including using DAO’s multi-sig wallet to govern the DeFi assets, vetting the smart contracts of the DeFi vaults, and monitoring the smart contracts and market developments.

Scope & Implementation

The proposal requests that US$1 million from the SPACE ID DAO treasury to be allocated to Latch’s USD stablecoin DeFi vault.

-

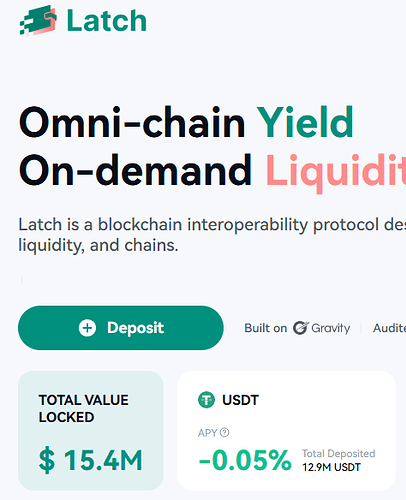

About Latch: Latch is an omni-chain yield and restaking protocol built on the Gravity chain. It aggregates DeFi yields from established protocols including Pendle, Ethena, Ether.Fi, etc. It has a proven track record of managing US$10M+ TVL. Its contracts have been audited by Slowmist, and the underlying assets deployed by its vault are fully transparent on-chain.

-

Omni-Chain Capabilities: Latch’s infrastructure is designed to operate across multiple blockchains, facilitating the cross chain needs to better manage SPACE ID DAO’s fundings, which come from and flow through multiple chains.

-

Automated DeFi Vault with Instant Liquidity: Latch’s automated DeFi vault and liquid staking solutions offer continuous yield optimization, and a diversified portfolio balancing both yield and liquidity. Such that SPACE ID DAO can tap liquidity on-demand.

Timeline

Start 2-4 weeks of due diligence now to further vet the Latch protocol, and evaluable the risk-return profile of Latch’s DeFi Vaults. After proposal approval, target to make deposit by mid December 2024.

Expected Outcome

-

Annual Yield: Expected DeFi returns of ~$100,000 annually (subject to market conditions), which can be used to fund future protocol initiatives.

-

Risk Mitigation: Ensuring safe deployment of treasury assets through Latch’s cross-chain infrastructure and smart contracts, and proper governance of the DeFi assets by DAO’s multi-sig.

-

Community Updates: Regular performance updates will be provided to the SPACE ID DAO, for transparency and community feedback on treasury management strategies.